- You have no items in your shopping cart

- Continue Shopping

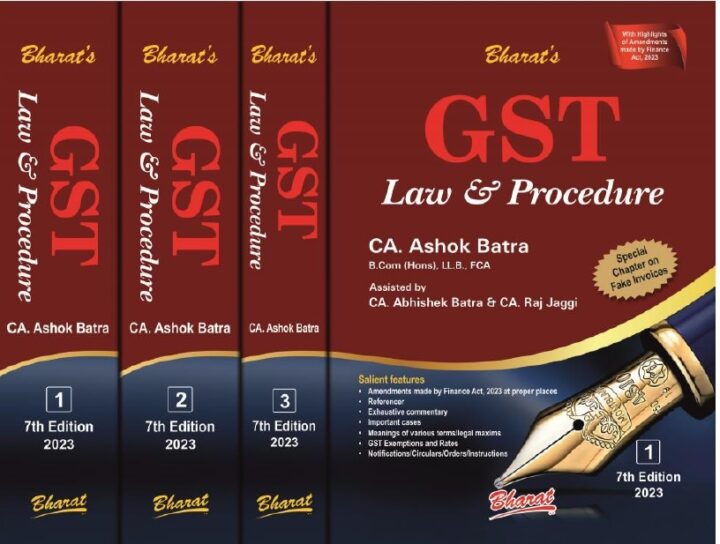

Bharat GST Law and Procedure

₹5,756Current price is: ₹5,756. Original price was: ₹7,195.

| Publisher | |

|---|---|

| Language | |

| Authors | |

| Binding Type | |

| Edition | |

| Date of Publication |

Bharat GST Law and Procedure

About G S T (Law & Procedure)

Volume 1

Division 1

Referencer

Referencer 1 Meanings of various terms used in GST

Referencer 1A Meanings of legal words, maxims/phrases

Referencer 1B Rules of interpretation of statutes including doctrines

Referencer 2 Goods and Services Tax Network (GSTN)

Referencer 3 Goods and Services Tax Council (GST Council)

Referencer 4 Taxes/Duties/Cesses and Surcharges Subsumed inGST

Referencer 5 Non-GST Supply

Referencer 6 Important issues regarding Summons issues undersection 70 of the CGST Act, 2017

Referencer 7 Extension of due dates for furnishing different returns

Referencer 8 State/UT Codes

Referencer 9 Kerala Flood Cess

Referencer 10 Job Work under the GST Act(s)

Referencer 11 Works Contract Services under the GST Act(s)

Referencer 12 Different types of persons under GST

Referencer 13 Different types of supply under GST

Referencer 14 Rate of interest payable under different situations

Referencer 15 Penalties, Late Fee and Fine under GST

Referencer 16 Illustrative cases in which penalty or late fee has beenwaived

Referencer 17 Prosecution under GST Act(s) — Sections 132 and 133

Referencer 18 Compounding of Offences — Section 138

Referencer 19 Production of Additional Evidence — Rule 112

Referencer 20 Various GST Forms

Referencer 21 E-invoicing

Referencer 22 Suggestive format of tax invoice, bill of supply, receiptvoucher, refund voucher etc.

Referencer 23 Common Provisions under CGST/IGST/UTGST Act

Referencer 24 Scheme of broad classification of goods under GST

Referencer 25 Scheme of broad classification of services under GST

Referencer 26 Relevant Articles of the Constitution of India

Referencer 27 List of topic-wise Circulars/Instructions/Guidelines

Referencer 28 Gist of important/latest cases

Division 2

Exempted Goods and GST Rates on Goods

Part A Exempted goods under GST Acts namely CGST Act,IGST Act and respective SGST Acts

Part B Exempted Goods under IGST Act only

Part C CGST Rates of Goods with HSN Codes

Part D Exemption from compensation cess on supply of goods

Part E Compensation cess rates on supply of specified goods

Division 3

Exempted Services and GST Rates on Services

Part A Exempted Services under CGST, IGST and SGST Acts

Part B Exempted services under IGST Act Only

Part C CGST rates of services with accounting codes

Part D Compensation cess rates on services

Division 4

Practice and Procedure

Chapter 1 Introduction and Overview of GST including itsAdministration

Chapter 2 Concept of Supply including Intra-State & Inter-StateSupply

Chapter 3 Place of Supply of Goods or Services or Both

Chapter 4 Zero-Rated Supply (including Exports) and Imports

Chapter 5 Levy of Tax

Chapter 6 Exemption from Tax

Chapter 7 Registration

Chapter 8 Electronic Commerce including TCS

Chapter 9 Valuation of Taxable Supply

Volume 2

Chapter 10 Input Tax Credit

Chapter 11 Classification of Goods and Services

Chapter 12 Time of supply and payment of tax

Chapter 13 Reverse Charge under GST

Chapter 14 Tax Invoice, Credit and Debit Notes

Chapter 15 Returns

Chapter 16 Refunds

Chapter 17 Accounts and other records

Chapter 18 Offences, Penalties and Prosecution

Chapter 19 Transitional Provisions

Chapter 20 Assessment under GST

Chapter 21 Audit under GST

Chapter 22 Inspection, Search, Seizure and Arrest

Chapter 23 Inspection of goods in transit including E-Way Bills

Chapter 24 Demands and Recovery

Chapter 25 Appeals and Revision

Chapter 26 Advance Ruling

Chapter 27 Liability to pay in certain cases

Chapter 28 Miscellaneous Topics

Chapter 29 GST on Real Estate Sector

Chapter 30 Meanings of words & phrases frequently used instatutory provisions & rules

Chapter 31 Principles of interpretation of statutes including GSTActs

Chapter 32 Tax Planning under GST

Chapter 33 Issuance of invoice without supply – Fake/BogusInvoicing

Volume 3

Division 5

Statutory Provisions

Chapter 1 Central Goods and Services Tax Act, 2017

Chapter 2 Central Goods and Services Tax (Extension to Jammuand Kashmir) Act, 2017

Chapter 3 Integrated Goods and Services Tax Act, 2017

Chapter 4 Integrated Goods and Services Tax (Extension to Jammuand Kashmir) Act, 2017

Chapter 5 Union Territory Goods and Services Tax Act, 2017

Chapter 6 Goods and Services Tax (Compensation to States) Act,2017

Chapter 7 Constitution (One Hundred and First Amendment) Act,2016

Division 6

GST Rules

Chapter 1 Central Goods and Services Tax Rules, 2017

Chapter 2 Integrated Goods and Services Tax Rules, 2017

Chapter 3 Goods and Services Tax Compensation Cess Rules, 2017

Chapter 4 Goods and Services Tax Appellate Tribunal(Appointment and Conditions of Service of President andMembers) Rules, 2019

Chapter 5 Settlement of Funds Rules, 2017

Division 7

Notifications/Orders/Instructions

Part A Central Goods and Services Tax Notifications

2017

2018

2019

2020

2021

2022

2023

Part B Central Tax (Rate) Notifications

2017

2018

2019

2020

2021

2022

2023

Part C Integrated Goods and Services Tax Notifications

2017

2018

2019

2020

2021

Part D Integrated Goods and Services Tax (Rate) Notifications

2017

2018

2019

2020

2021

2022

2023

Part E GST Compensation Cess Notifications

2017

2018

2019

2022

2023

Part F GST Compensation Cess (Rate) Notifications

2017

2018

2019

2021

2023

Part G Central Tax Circulars

Part H IGST Circulars

Part I Compensation Cess Circulars

Part J Central Tax Orders

2017

2018

2019

2020

2022

Part K CGST (Removal of Difficulties) Orders

2017

2018

2019

2020

Part L Instructions/Guidelines

2017

2018

2019

2020

2021

2022

Division 8

Relevant Circulars & Instructions under Customs Act, 19

Circulars issued under the Customs Act, 1962

2017

2018

2019

2020

2021

2022

Instructions

2017

2018

2022

Bharat GST Law and Procedure

| Publisher | |

|---|---|

| Language | |

| Authors | |

| Binding Type | |

| Edition | |

| Date of Publication |