- You have no items in your shopping cart

- Continue Shopping

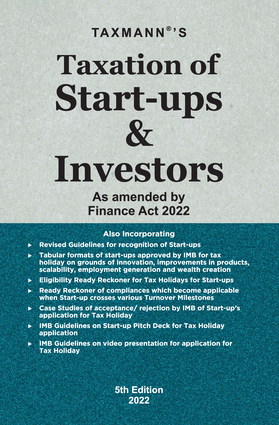

Taxmann Taxation of Start-ups and Investors

₹1,436Current price is: ₹1,436. Original price was: ₹1,795.

| Publisher | |

|---|---|

| Language | |

| Authors | |

| Binding Type | |

| Edition | |

| Date of Publication |

Taxmann Taxation of Start-ups and Investors

This book provides focused analysis, starting from recognising start-ups to their taxation. It includes DPIIT Guidelines, IMB Decisions, relevant legal provisions, Case Laws, etc. It also provides a start-up ready reckoner. This book is amended by the Finance Act 2022.

Taxmann Taxation of Start-ups and Investors Description

This is a handy book for the taxation of start-ups & investors, including, but not limited to the following:

- Tax Holiday u/s 80-IAC of the Income-tax Act 1961

- Angel Tax Exemption

All topics related to the taxation of start-ups & investors are discussed in light of the following:

- Department for Promotion of Industry and Internal Trade (DPIIT) Guidelines

- Inter-ministerial Board (IMB) Decisions made in IMB Meetings

- Relevant Legal Provisions

- Case Laws

The Present Publication is the 5th Edition, authored by Taxmann’s Editorial Board. This book is updated by the Finance Act 2022, with the following noteworthy features:

- [Start-up Ready Reckoner]

- Eligibility Ready Reckoner for tax holiday u/s 80-IAC

- Compliance Ready Reckoner for turnover-limit linked compliances/exemptions for the following entities:

- Private Companies

- Limited Liability Partnership

- Traditional/General Partnership Firm

- Tax Benefits available for DPIIT recognised start-up private limited companies based on their turnover

- [Tabular Format of Tax Holiday for Start-ups approved by IMB] in the following cases:

- Grounds of Innovation

- Grounds of Scalability

- Grounds of Employment Generation or Wealth Creation

- Grounds of Improvement in Products

- [Detailed Analysis of Finance Act 2022 Amendments] on discharging additional onus on loans/borrowings credited in books

- [Detailed Analysis with a Specific Focus] on the following topics:

- Revised Guidelines for recognition of start-up

- Process of IMB Certification for a tax holiday

- Options of low tax rate regime u/s 115BAA/115BAB without tax holiday

- Relative tax efficacy of various start-up entity forms, such as:

- Registered Partnership Form

- Limited Liability Partnerships

- Private Limited Companies

- One Person Company as a start-up entity form

- Dispute Resolution Scheme for small/medium taxpayers

- Taxability of investors and eligibility under section 54GB with practical examples

- [Case Studies] of acceptance/rejection by IMB of a start-up’s application for a tax holiday

- [FAQs] are given at the start of the book

- [Detailed Analysis of Difference between MSMEs and Start-ups] and benefits available under the MSMED Act, 2006

The detailed contents of the book are as follows:

- What are a start-ups

- Distinction between start-ups and MSMEs

- What is the criteria for recognition of start-ups by DPIIT

- Start-ups eligible for DPIIT-Recognition

- OPC as a start-up entity

- Innovation/scalable business model

- Start-up entities not eligible for DPIIT recognition

- Sole proprietorships – whether eligible for DPIIT recognition

- Entities formed as a result of amalgamations/mergers/demergers/absorption whether eligible for DPIIT recognition

- Entities formed as a result of compromise/arrangement – whether eligible for DPIIT recognition

- Holding & subsidiary companies – whether eligible for DPIIT recognition

- Joint Ventures – whether eligible for DPIIT recognition

- Entities incorporated outside India – whether eligible for DPIIT recognition

- Entities with foreign shareholding/stake – whether eligible for DPIIT recognition

- Entities formed by splitting up/reconstruction of an existing business – whether eligible for DPIIT recognition

- Entities incorporate with common director/DP/partner – whether eligible for DPIIT recognition

- Procedure for DPIIT-recognition of start-up

- Name change by DPIIT-recognized start-up entity – whether permitted

- CIN/LLPIN change by DPIIT-recognized start-up entity – whether permitted

- Conversion by a DPIIT-recognized entity from one form to another – whether permissible

- Automatically ceasing to be a ‘start-up’ under LSN

- Approvals needed by start-up entity for claiming tax benefits

- Tax efficacy of different start-up entity forms – firms, LLPs & Pvt. Companies

- Tax holiday to start-ups under Section 80-IAC

- Funding blues of private limited start-up companies

- Tax implication of funding a start-up by investing in it money from the sale of the residential property invested in the start-up – Section 54GB

- Exemption from ‘angel tax’ to private limited companies start-ups

- Computation of FMV of shares issued when angel tax exemptions is not applicable

- Conditions for carry forward or set-off of losses of start-up PLC under section 79

- Deferring TDS or tax payment in respect of ESOP income of employees of eligible start-ups

- Mandatory acceptance of payments through prescribed electronic modes if turnover exceeds INR 50 crores – section 269SU

- Constitution of dispute resolution committee for small and medium taxpayers

- Taxation of investors exiting start-ups

- Tax on reconstitution of firms/LLPs

Taxmann Taxation of Start-ups and Investors

| Publisher | |

|---|---|

| Language | |

| Authors | |

| Binding Type | |

| Edition | |

| Date of Publication |